The pharmaceutical industry and the life sciences sector at large have always been familiar with morality and ethical dilemmas. Their missions are to advance science, extend and save lives, improve the world, provide food security and ensure healthier societies. These goals are closely intertwined with following the societal zeitgeist on hot-button issues: from cloning, to genetically modified organisms and other high-profile controversies, we are no strangers to controversy.

Yet human conflicts provide more challenging questions – the Russian invasion of Ukraine has made this plain so far. As we have watched industry after industry be excluded from Belarus and Russia due to sanctions, the life sciences have so far been exempted. Voluntary actions taken by individual companies have been conservative so far – despite growing calls from western markets and audiences to do more. We examine the response from the biggest names in the life sciences industry, and the effects they will have.

The Cost of Action

The majority of pharma has announced plans to help Ukraine through humanitarian aid so far. This includes medical devices giant Abbott’s commitment of $2m to assist Ukraine, as well as Bayer’s employee-donation matching scheme for the Ukrainian Red Cross, which has raised 900k euros so far. AstraZeneca has also contributed ~$4m in medicines and relief efforts for Ukraine. Yet the actions taken to sanction Russia from within the pharma industry remain extremely slim. Part of this has to do with Russia’s Pharma-2020 plan, announced in 2010. The plan required pharmaceutical companies hoping to sell to Russian customers to relocate some production capabilities inside Russia. This means that blocking services to Russia does not merely come at the expense of losing market share – but also manufacturing potential.

Additionally, over the last decade, Russia has carefully cultivated a permissive and lax environment hoping to attract the pharma industry to the country for clinical studies. According to Reuters, there are 842 clinical trials currently underway in Russia – although other sources place the figure much higher at 3072. Such trials included those for Paxlovid, one of the most effective approved antiviral treatments for COVID-19, produced by Pfizer. This underscores the high cost of ceasing activities in Russia – but other sectors have already had to bear such costs.

Given these numbers, it is easy to understand the decisions many pharmaceutical giants have made so far. The recruitment of new clinical trial participants has largely been paused in Ukraine, with some companies also halting promotion and recruitment in Russia. Considering that the top sponsors of clinical trials in Russia are AstraZeneca and Merck, the continued disruption of these activities may have far-reaching implications – though most are will be able to re-pivot their efforts elsewhere in Eastern Europe.

No Pulling Out

Still, none of the big companies have shown any appetite to pull out of Russia. Hundreds of drugmaker CEOs and other stakeholders have called on business leaders at large to disengage from the Russian economy in an open letter. But these are mostly from smaller and medium-sized companies, such as Alnylam, Biogen, Seagen, and others. The response from larger companies has remained largely unchanged. One of the most illustrative examples of this may be Bayer. Bayer does not only provide critical pharmaceuticals: after its acquisition of Monsanto, the company is one of the leading providers of agricultural technologies and GMO seeds. Consequently, their response to the conflict will be critical – as it can have reverberating consequences throughout the world. Bayer has so far announced it will be halting all non-essential business to Belarus and Russia. Non-essential business is defined as advertising, capital investment and new business developments – the provision of products will however, continue.

Bayer faces calls to stop the supply of its entire portfolio to the entire country, but the company has not yet decided to escalate to that point. Bayer leads in market share for pharmaceuticals in Russia, and is one of the biggest players for patented seeds and pesticides on a worldwide scale. The company notes that they reserve the right to refuse to provide agricultural products and services for the 2023 growing season should Russia continue the war. Such a step could have world-wide ramifications, disrupting food supply chains and food security – with devastating effects to Russian agriculture.

Pills versus Hamburgers?

The very reason life sciences companies have been excluded from western sanctions targeting Russia is because the provision of healthcare-related products and services is considered essential and critical. According to analysts, Russia only accounts for 2% of the global revenue for drug suppliers, although 85% of Russian drugs depend on imported ingredients. This highlights the highly effective and asymmetrical effect sanctions in the industry could have on Russia. But should the Russian population, much of which has had no hand in provoking this war, face unearned suffering and be deprived of life-saving products? This is the line of thinking much of the industry has taken.

But is the privileged position of the industry justified? Russians are already facing unprecedented economic consequences, which cause unearned suffering. The rouble has already lost nearly half of its value against the dollar – evaporating the fortunes of Russians overnight. Is the value of money – the very money with which to buy food, essential services, and lifesaving medicines – not equally as important as healthcare products? We have no qualms about crumbling the value of Russian currency, but the non-restriction of medicine remains sacrosanct.

The war in Ukraine has raised interesting questions regarding the role of the life sciences industry in conflicts around the world. The moral dilemmas it faces, and the way it responds to them, will shape its reputation for years to come. Many argue that if the industry aims to save lives, then it should also aim to oppose and stop unnecessary conflicts by isolating aggressors. So far, inaction has seemed to be the preferred course of action – despite growing calls from around the West for pharma to take a stand. Whether this remains the case, and whether this is the right decision, is yet to be seen.

Nick Zoukas, Former Editor, PharmaFEATURES

Subscribe

to get our

LATEST NEWS

Related Posts

Clinical Operations

Supervised Learning: Harnessing Data to Revolutionize Patient Care

As healthcare enters a new era, the integration of ML promises to revolutionize oncology and medicine.

Clinical Operations

The Interplay of Public and Private Sectors in Pharmaceutical Innovation

A delicate balance between public and private investments shapes the pharma R&D landscape.

Read More Articles

Synthetic Chemistry’s Potential in Deciphering Antimicrobial Peptides

The saga of antimicrobial peptides unfolds as a testament to scientific ingenuity and therapeutic resilience.

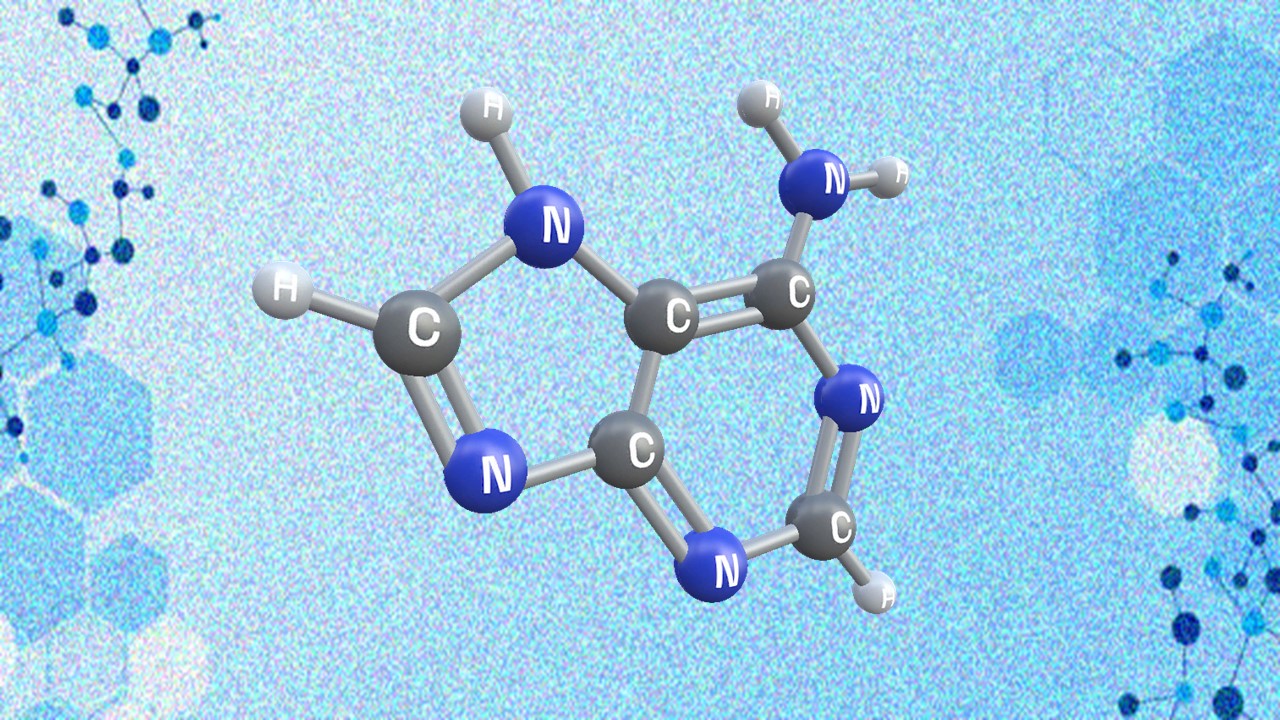

Appreciating the Therapeutic Versatility of the Adenine Scaffold: From Biological Signaling to Disease Treatment

Researchers are utilizing adenine analogs to create potent inhibitors and agonists, targeting vital cellular pathways from cancer to infectious diseases.