Johnson & Johnson to focus on pharmaceuticals, spinning off consumer health products

12 November 2021

In a bid to stimulate further growth for Johnson & Johnson (J&J), the company plans to spin off its stagnating consumer products division. Stocks for J&J are expected to appreciate in value, as the company will retain its pharmaceuticals division. The spinoff is expected to cost up to $1 billion as the separation unfolds over the next 18-24 months, with shares for J&J already up at the time of announcement. While this may be surprising news for the world’s largest healthcare company, the primary growth for J&J has originated from its medical devices and therapeutics divisions. However, the company brand remains more strongly associated with baby shampoos and other consumer health products, despite them only accounting for 15.6% of the estimated revenue for 2021. The breakup of the company is expected to ameliorate this disconnect. The name for the new consumer healthcare company remains to be announced, and expectations for whether the spin-off growth could maintain strong growth of its own should be cautious.

Novartis sells $21b Roche stake

04 November 2021

Novartis & Roche have agreed a transaction for Novartis to sell off its Roche shares, estimated to be worth $20.7 billion – a 33% stake in Roche altogether. Novartis acquired the stake in 2001 for $5 billion, and reports that it no longer considers its investment in Roche to be a strategic asset. Roche agreed to buy the shares and then cancel them to reduce capital. Novartis had acquired the stake from Martin Ebner, who had grown frustrated with Roche and hoped that selling the shares to one of its rivals would bring about strategic change. Investment bank Jefferies expects the transaction to result in an earnings increase of 7% per share. As Novartis liquidates this stake, analysts expect them to proceed with new investments in the near future, to further stimulate growth. Bloomberg reports that Alnylam Pharmaceuticals Inc. could be a prime acquisition.

Alphabet launches new AI company focused on drug discovery

05 November 2021

Alphabet, Google’s parent company, will be launching Isomorphic Labs – a new company focused on reimagining drug discovery with an AI-first approach. The company will be led by Demis Hassabis, who is also the CEO of DeepMind – a British AI startup acquired by Alphabet in 2014.

It is expected that Isomorphic Labs will draw from DeepMind’s significant experience in AI, particularly from relevant projects such as AlphaFold. AlphaFold made headlines last year with its ability to predict protein folding in a matter of days, a process that will no doubt be relevant for drug discovery.

Takeda buys GammaDelta Therapeutics

27 October 2021

Japanese Takeda acquired British firm GammaDelta through a successful “build-to-buy” partnership, initiated in 2017, in exchange for a pre-negotiated upfront payment and subsequent goals-based milestone payments. The acquisition expands Takeda’s immune-based therapies for cancer, with the company already being considered an innovator in immuno-oncological treatments. GammaDelta had already begun a phase I trial for a gamma-delta T cell treatment, GDX012, for acute myeloid leukemia, earlier this year. With Takeda having already made other acquisitions earlier this year, such as Maverick Therapeutics, to advance its T cell-based therapies, it is expected that the company will only grow further in the field of immuno-oncology.

Science 37 partners with CMIC and 3H Medi Solution

28 October 2021

Science 37, a Decentralised Clinical Trials (DCT) innovator firm, has announced a new partnership with two Japanese CROs – CMIC and 3H Medi Solution. This expands Science 37’s network, as well as its global reach: the firm’s network already includes companies such as Novartis, Sanofi, Genentech, and others.

With CMIC being the largest CRO in Japan, with a 28 year history in the industry, this partnership will boost Science 37’s position in the country and should also accelerate clinical trials in the area. Science 37 had already partnered with Japanese Otsuka Pharmaceutical in 2017.

Science 37 specialises in providing technology to enable electronic consent, telemanagement, patient management and mobile nursing. These virtual clinical trial technologies will no doubt continue to prove useful, given the background of the COVID-19 pandemic.

Clinical Ink acquires Digital Artefacts

08 November 2021

Clinical Ink, an established Decentralised Clinical Trials (DCT) firm, announced its acquisition of Digital Artefacts – a competitor also providing end-to-end DCT. Clinical Ink already has a leading position in the global DCT sector. Its Lunexis platform is one of the leading systems for virtual trials and provides unprecedented flexibility for patients and researchers in organising their trials.

With Digital Artefacts’ expertise in complex cognitive, behavioral and physiological data capture, Clinical Ink’s position in DCT will only be further solidified. Joan Severson, co-founder and president of Digital Artefacts, said as much:

“We are very excited to join Clinical Ink and enhance the seamless data collection, cognitive and behavioral assessments, and quantitative outcomes for even the most complex studies.”

The growth of DCT in the clinical trials sectors is expected to be permanent, rather than a temporary measure adopted to counteract social distancing requirements. COVID-19 acted as a catalyst in their adoption, but the streamlining offered by virtual trials, as well as the efficiency they bring to the entire process is now clear – as indicated by the burgeoning partnerships and acquisitions by firms in the industry.

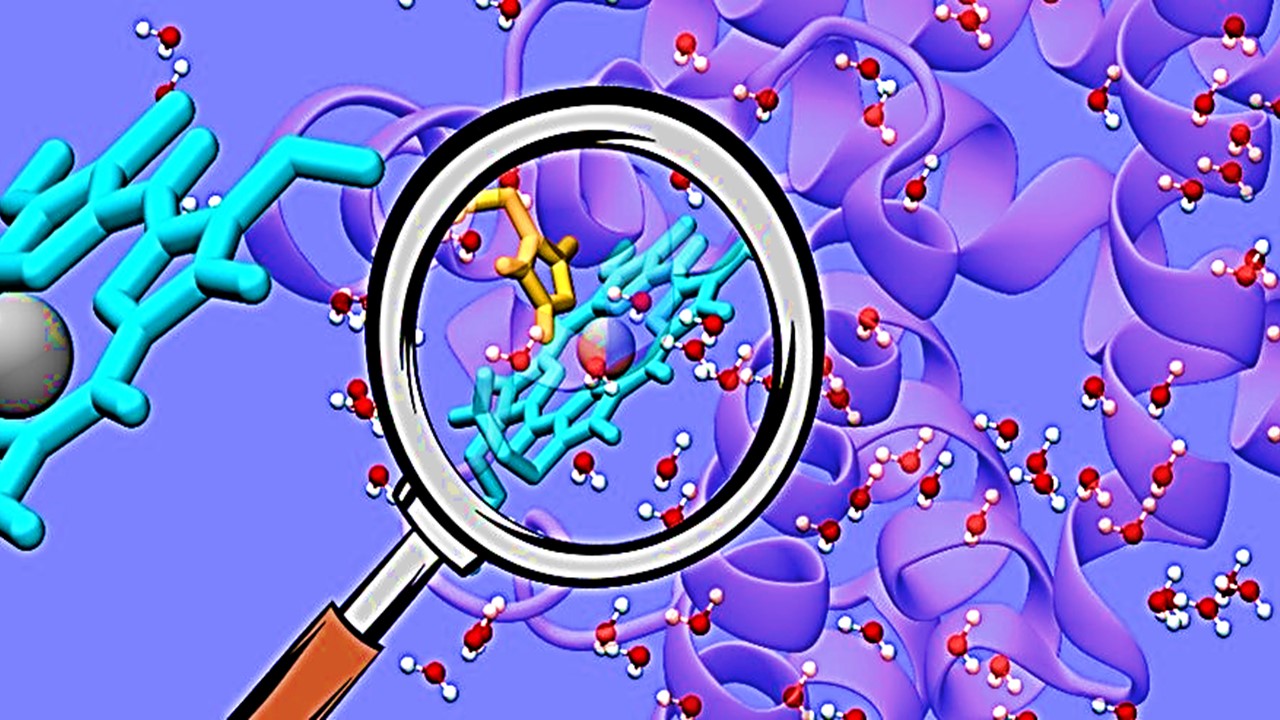

Novo Nordisk acquires Dicerna Pharmaceuticals

18 November 2021

Danish firm Novo Nordisk announced plans to acquire Dicerna Pharmaceuticals for $3.3 billion. Novo Nordisk and Dicerna had previously entered a partnership in 2019 for developing RNAi treatments. Dicerna’s specialisation in the area of using RNA interference (RNAi) technologies to silence disease-related genes will benefit Novo Nordisk, accelerating their own R&D. Dicerna CEO had the following to say about the acquisition, forecasting benefits in treatment delivery:

“The combination of Dicerna’s expertise in RNAi and oligonucleotide therapeutics and highly skilled employees with Novo Nordisk’s industry leadership in developing and commercialising medicines to treat serious chronic diseases, has the potential to significantly accelerate and expand our mission to deliver GalXC RNAi therapies for the benefit of patients and all our stakeholders”.

A large pharmaceutical company acquiring such a specialised firm for $3.3bn shows a clear expectation that RNAi will continue to grow as a treatment option in coming years. Other trends seem to reinforce this belief, with Alnylam – perhaps the leading RNAi firm – showing strong growth and delivering products.

Nick Zoukas, Former Editor, PharmaFeatures

Subscribe

to get our

LATEST NEWS

Related Posts

Leadership, Trends & Investments

The Immigrant, The Career-Undecided, and The Supermarket Supervisor-turned-Scientist

Learn more about the 1947, 1988, and 2008 Physiology or Medicine Female Nobel Laureates.

Leadership, Trends & Investments

Breaking Barriers in Radiopharmaceuticals: The Pioneering Leadership of Roseanne Satz

Roseanne Satz breaks barriers with her commitment to diversity and innovation in radiopharmaceuticals.